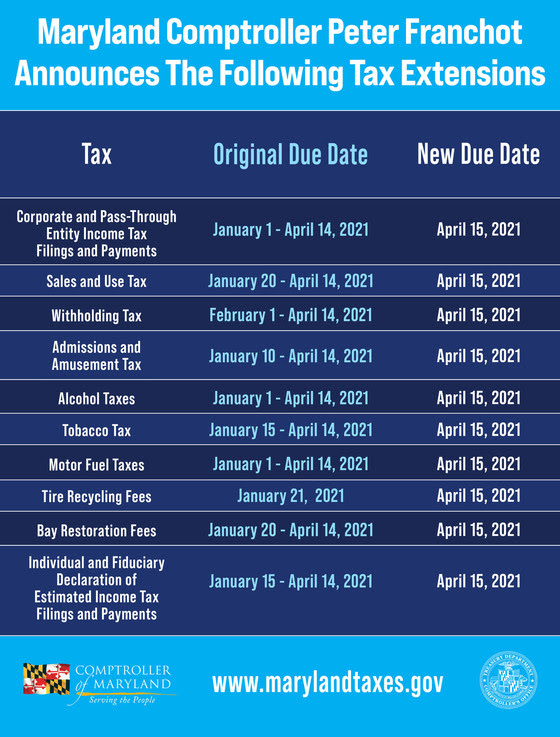

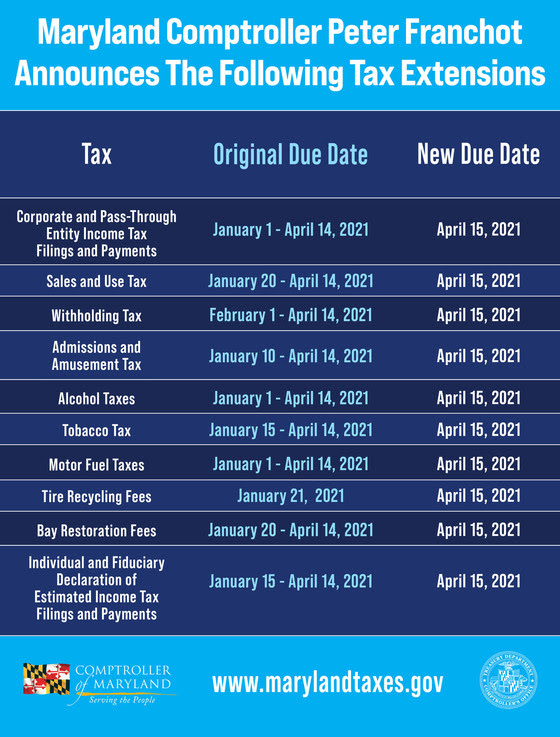

Extension also provided for withholding and estimated income tax filings and payments

| ANNAPOLIS, Md. (January 6, 2021) – Comptroller Peter Franchot today announced that his agency has extended filing and payment deadlines for certain Maryland business taxes and quarterly estimated income tax returns and payments that would be due in January, February and March 2021 until April 15, 2021. The action is similar to an extension granted last year to businesses during the early stages of the COVID-19 pandemic. No interest or penalties will be assessed and there is no need to file a request for extension. |

| “My directive for a tax forbearance that is interest and penalty free is a direct and immediate economic stimulus for Maryland businesses and workers — a decision that we estimate keeps more than $1 billion in consumers’ pockets and helps businesses keep their lights on,” Comptroller Franchot said. |

| Businesses and self-employed individuals or independent contractors with estimated income tax returns and payments due on January 15, 2021 also will be granted an extension until April 15, 2021. |

| “As businesses await approval of applications for grants and loans, receipt of funds and additional federal government action, these tax extensions immediately alleviate financial pressures during challenging times,” Comptroller Franchot said. “Just like last year when we gave businesses a breather, after 90 days, taxpayers will remit what is due, ensuring this action is budget neutral for the State of Maryland.” |

| Employers must complete their 2020 withholding tax returns and payments due by January 31, 2021, ensuring that W-2s will be delivered on time for taxpayers to file when the tax season begins at the end of January. Any State withholding returns and payments originally due between February 1, 2021 and April 14, 2021 may be submitted by April 15, 2021 without incurring interest and penalties. Employers must still file and pay Federal withholding taxes. |

| The extension applies to business taxes administered by the Comptroller: sales and use, admissions and amusement, alcohol, tobacco, and motor fuel tax, as well as tire recycling fee and bay restoration fee returns and payments with due dates between January 1, 2021 and April 14, 2021. |

| Also, if the IRS extends its April 15, 2021 filing deadline for 2020 corporate, pass-through entity and individual income tax returns, Maryland will once again conform to the IRS action. |

| These extensions apply only to tax filings under the authority of the Comptroller of Maryland. Taxpayers may need to consult other state agencies regarding the deadlines for other tax filings, such as personal property or unemployment insurance. |

| For more details about today’s announcement, please see the Comptroller’s official Tax Alert. |

|